Dear Friends and Readers,

Today is my final post. I made the decision some time ago but decided to await the tenth anniversary of my first post to retire from political blogging (nearly 3000 posts later). On October 15, 2010, I wrote, “I feel very strongly that this country is headed in the wrong direction. By that I mean it is heading away from its founding principles. This has been happening for a long time but the acceleration in the wrong direction under Barack Obama has been breathtaking.”

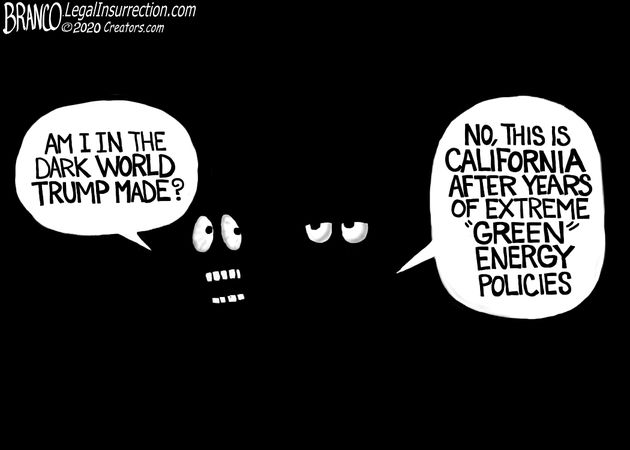

Well, Obama is gone and we were lucky enough to have a new President who puts America first. However, I am sad to say that the nation did not begin to heal and realize the importance of our constitution and the brilliance of our founding fathers. Indeed, things are worse.

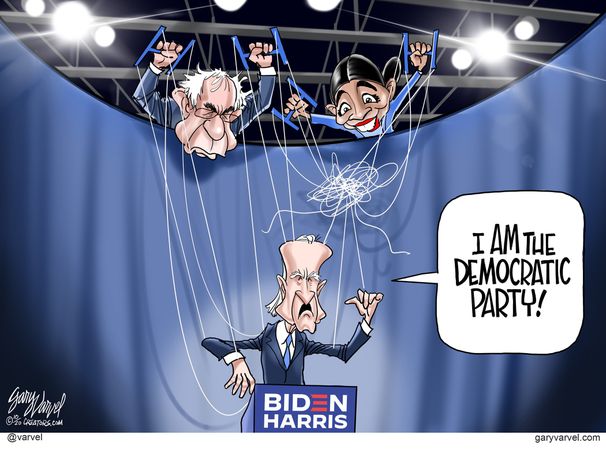

The foundation of our nation strongly depended on a free press. That no longer exists. The “free press” has become a wing of the Democrat Party.

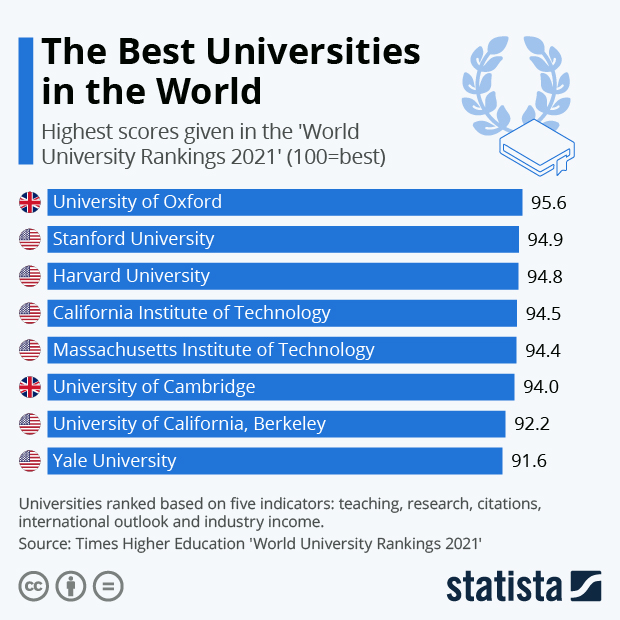

Goebbels knew that the way to take over a nation was to win the minds of the youth of the nation. Our colleges have simply become another wing of the Democrat Party.

A friend, DT, and political blogger also, shared an editorial by Tom Klingenstein with me. I will draw from Mr. Klingenstein’s excellent piece. It is important that my readers understand that I did not choose the name The Rugged Individualist hastily. I believe the American Way is founded on individual rights, the rule of law, and a shared understanding of the common good. It is a way of life that values hard work and self-reliance.

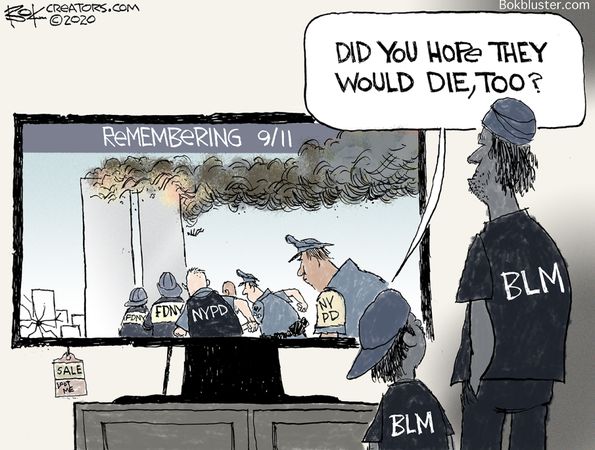

By contrast, the modern leftists see our nation through the prism of “identity politics” or “intersectionality.” I have written many times about “identity politics” and its dangers. But I never realized just how dangerous it was.

As Mr. Klingenstein points out so appropriately, the leftist agenda “is a revolutionary movement. I do not mean a metaphorical revolution. It is not like a revolution; it is a revolution, an attempt to overthrow the American Founding…”

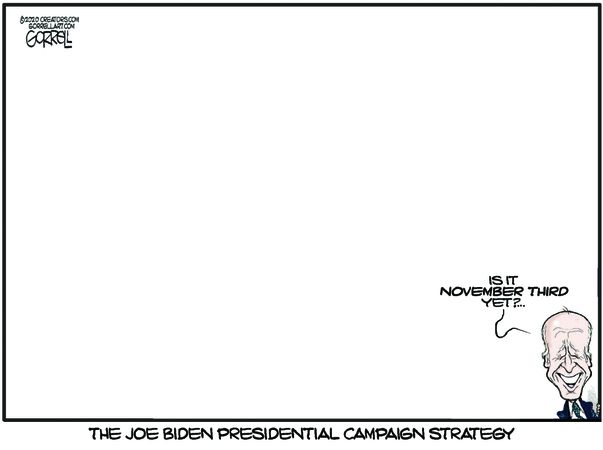

Political junkies like myself always hear this refrain every leap year: “This is the most important vote you will cast in your lifetime.” But, when they are tearing down statues of Lincoln and Frederick Douglass then we are truly voting for the difference between the America espoused by the “1619 project” versus the 1776 project that has worked ever so hard to live up to the magnificent prose of Thomas Jefferson (yet another great American who must be vilified).

I did not vote for President Trump to be my spiritual counselor, to teach me rhetoric, or because he was a silver-tongued orator. (Indeed, Obama was a “silver-tongued orator” and he was the worst president EVER.) As Mr. Klingenstein observes, “Above all else, and above anyone else, Trump is committed to America. He is unreservedly, unquestionably pro-America. He feels no guilt for America’s past. He makes no apologies. He concedes nothing. These may not always be the attributes one wants in a President, but in this day of woke guilt they are the most essential things. And Trump has unlimited confidence in America.”

Amen to that, Mr. Klingenstein!

The America that I know and love is definitely not “systemically racist.” If the Americans that I know and respect are anything, they are systemically committed to freedom and equal rights for all.

Although I am retiring as a political blogger I still believe what I wrote in my first post: “It matters little to me whether anyone ever reads what I write, but the need within me to write about my perceptions is profound. An argument needs to be made. Every individual needs to speak out, if only to say ‘I disagree.’”

May God help and save this wonderful nation from the fools who cannot understand how fortunate they are to be an AMERICAN (no hyphenation ALLOWED)!

Roy Filly